State Supported Greenhouse Loan (7 Years Maturity - 2 Years Non-Repayment)

02 April 2024 Tuesday

State Supported Greenhouse Loan (7 Years Maturity - 2 Years Non-Repayment)

State Supported Greenhouse Loan (7 Years Maturity - 2 Years Non-Repayment)

Greenhouse growers are specifically supported by the state for the financing needed for greenhouse agricultural activities. You can get greenhouse loan support from Ziraat Bank, which provides loans with low interest rates, or you can also apply for the support provided by the Agriculture and Rural Development Support Institution (TKDK).

What is Greenhouse Loan?

Greenhouse Loan, as the name suggests, is a type of loan provided specifically to greenhouse farmers for greenhouse agricultural activities. Greenhouse loan, which is interpreted as a grant by the public, is a type of loan with a 2-year grace period, interest-free and flexible lending offered by Ziraat Bank to farmers who want to invest.

Greenhouse Loan: It is a loan developed for entrepreneurs who want to invest in greenhouse farming and investors who want to improve their existing greenhouses. In addition to establishing a new greenhouse with a greenhouse loan, you can enlarge your greenhouse and make the necessary renovations without any difficulty.

State Support for Greenhouse Agriculture

Supports Provided by the State for Greenhouse Production are as follows:

1 -Loans with Interest Discount

- Investment and Business Loans

2 - Rural Development Investment Support Programs Under the Title of Traditional (Common) Crop Production

-Economic Investments

3 - Allocation of Pasture Areas to Geothermal Heated Technological Greenhouses

4 - Treasury Lands Usage Permit

5 - Regional Investment Incentives

6 - Regional Investment Incentives

7 - Supports Provided During the Operation Phase

In our content, the details of the loans provided to greenhouse cultivation as investment and business loans with interest reductions are explained.

Ziraat Bank with interest-reduced greenhouse loan:

The greenhouse loan covers 75% of the investment cost.

Mortgage secured loans are evaluated up to a maximum maturity of 120 months.

These are loans with installment payments up to 3, 6, 12 months.

The greenhouse agricultural loan granted in 2022 will have a maturity of 7 years and a grace period of 2 years, depending on the project content.

Agricultural Credit Cooperative, through Ziraat Bank, can provide cash support with a maximum amount of 25 million TL, with interest discounts from 50 percent to 100 percent, to those who produce in accordance with modern greenhouse and controlled greenhouse farming conditions.

For active greenhouse businesses, zero-interest loans of up to 50 thousand liras can be used for improvements.

For support for relevant production, you can find details under the greenhouse cultivation section of the Ministry of Agriculture and Forestry.

What are the documents required to get a Greenhouse Loan?

Applications are made by going to the branches of banks that provide Greenhouse Loans. Some documents are required for agricultural support during the application.

Documents Required to Take out a Greenhouse Loan are as follows;

Photocopy of identity card,

Place of residence,

farming certificate,

business certificate,

Controlled greenhouse recording system certificate,

Land title documents, lease contracts,

If collateral is requested, all relevant documents,

3-year balance sheet and income statement for those who keep books on the balance sheet basis,

If a greenhouse is to be purchased, an expertise certificate for the greenhouse,

If the greenhouse is newly built or renovated, proforma and final invoice are required documents.

Additional documents and guarantees may be requested if deemed necessary after an evaluation at the relevant bank branches. State-supported loans are given to entrepreneurs who make or will make domestic production by KOSGEP, BEBKA, Ziraat Bank and other state banks.

Ziraat Bank State Supported Greenhouse (Greenhouse) Loan

With its crop production loan campaign, Ziraat Bank provides special greenhouse loans to greenhouse farmers in order to cover the financing of the operating expenses of greenhouses through investment and business loan products.

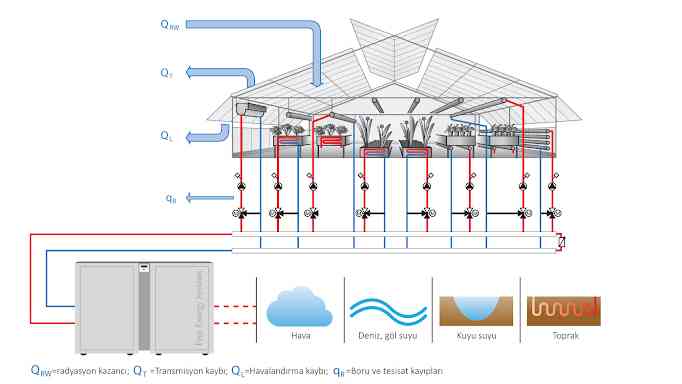

It consists of business and investment loans offered for the needs of citizens engaged in plant production such as controlled greenhouse, garden, field and soilless production.

Greenhouse loans given to enterprises that produce in accordance with the regulation on the registration of greenhouse production and are registered in the greenhouse registration system (ÖKS) are within the scope of state-supported loans.

Expenses such as fertilizer, pesticide, transportation and insurance required for production are financed with business loans.

You can pay all the expenses necessary to purchase and establish new greenhouses, gardens, warehouses, etc., as an investment loan.

If the production issue is suitable, subsidized, low-interest state-supported greenhouse loans will be provided to producers who comply with the articles listed in the Presidential Decree dated 2022.

What are you waiting for a profitable investment?

Call Us Now!

444 2 548